crypto tax calculator canada

Coinpanda generates ready-to-file forms based on your trading activity in less than 5 minutes. See How Easy It Is.

Cryptocurrency Tax Guides Help Koinly

CryptoTraderTax is the easiest and most intuitive crypto tax calculating software.

. The features list is indeed long and depends on your subscription. Are you prepared for tax season. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

This Atlanta Startup Battle 70 finalist prides itself on nailing cost bases. Capable of handling hundreds of thousands of transactions BearTax is the best crypto tax calculator for prolific traders and bots. Download Schedule D Form 8949 US only Reports and software imports eg.

Cryptocurrency Tax Calculator. Join over 100000 crypto investors calculating their profits losses and tax liabilities today. After-tax income is your total income net of federal tax.

BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Canadian citizens have to report their capital gains from cryptocurrencies. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains.

Discover how much taxes you may owe in 2021. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the. Get help with your crypto tax reports.

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. CoinTracker helps you become fully compliant with cryptocurrency tax rules. Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains.

Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. Please enter your income deductions gains dividends and taxes paid to get a summary of your results.

Crypto tax calculator is one of them designed specifically for hmrc tax laws. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada. It was developed with the.

Bitcoin Tax Calculator for Canada. CryptoTraderTax is the fastest and easiest crypto tax calculator. Download your tax reports in minutes and file with TurboTax or your own accountant.

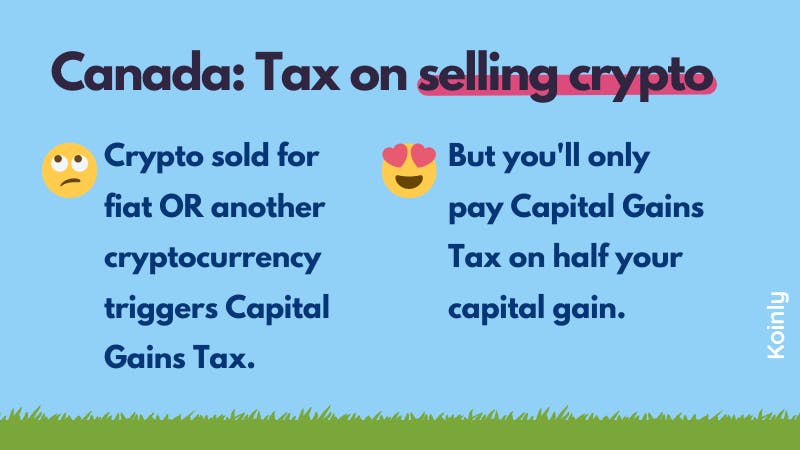

You can calculate this in a couple of different ways but the easiest way is to add up all your capital gains and then halve the amount. Only half your crypto gains are taxed. Log in Sign Up.

Paying taxes on cryptocurrency in Canada doesnt have to be a headache. Crypto Tax Calculator. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs. You can use crypto as an investment as a currency for spending or as a source of passive income. Capital gains tax report.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Read The Ultimate Crypto Tax Guide. Guide for cryptocurrency users and tax professionals.

It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting. The exchange offers a lot of guidance on crypto taxation around the world including Canada crypto taxes. However there is always an option to prepare a CSV and upload it to calculate your crypto taxes.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a. You shouldnt even need to go into your account to generate an API.

TurboTax TaxACT and HR Block desktop 9999999e06. Therefore its likely theyve faced pressure from tax authorities not just the CRA. Straightforward UI which you get your crypto taxes done in seconds at no cost.

Report crypto on your taxes easily using Koinly a crypto tax calculator and software. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Crypto Tax Calculator is a premium crypto tax accountancy utility.

Full support for US UK Canada and Australia and partial support for others. Calculate and report your crypto tax for free now. Canada has a couple of tax breaks that crypto investors will be interested in.

Automated Crypto Trading With Haru. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. If youre using a crypto tax calculator API is the easiest route.

Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. Become tax compliant seamlessly. Youll only pay Capital Gains Tax on half your capital gains.

Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. Currently only popular exchanges in the mentioned jurisdictions come with API sync. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

Demystify Crypto Taxes All blog post Tag. These calculations are approximate and include the following non-refundable tax credits.

Crypto Tax Canada Ultimate Guide 2022 Koinly

Crypto Tax Canada Ultimate Guide 2022 Koinly

Crypto Tax Canada Ultimate Guide 2022 Koinly

Crypto Tax Canada Ultimate Guide 2022 Koinly

Crypto Tax Canada Ultimate Guide 2022 Koinly

Crypto Tax Canada Ultimate Guide 2022 Koinly

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income